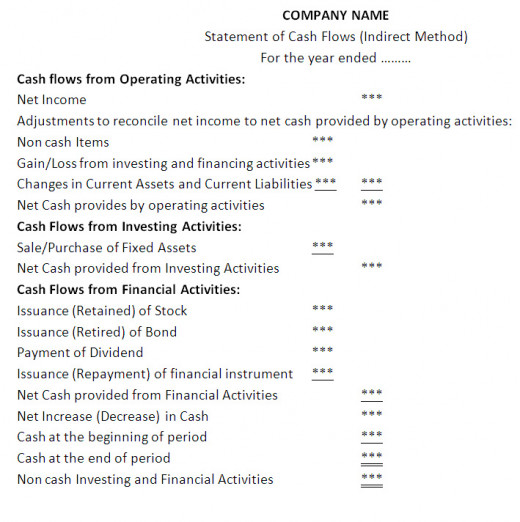

How to Prepare the Statement of Cash Flows

The statement of cash flows shows the information about the amount of cash receipts and cash payments during a period. It provides the details information about how much cash is provided by operating activities , how much cash is utilized for investing activates and how much cash is obtained from debt and stock and cash providing them return with on their investment. The company prepares the statement of cash flows analyzing the company’s cash generating capability. This financial statement of cash flows is prepared by using two different methods which are direct method and indirect method. Between two methods direct method is mostly used because of it less complexity and less costly to prepare.

The difference between direct and indirect method of cash flows statement is that direct method determine cash receipt and payment by operating activities in the income statement in cash, on the other hand indirect method adjust non-cash items with net income and changes of current assets and liabilities. FASB prefers direct method but allows both of them.

Which method do you prefer for preparing cash flows statement?

Here illustrate the preparation of cash flows statement using indirect method. Lets see which information is required to prepare a cash flows statement-

- Comparative Balance Sheet: The current year (period) and the previous year’s (period) balance sheet is required to compare the changes in assets, liabilities and share holder’s equities.

- Current Income Statement: The details information of income statement’s item is required to determine the amount cash used by operating activities.

- Additional Information: The adjusted entry’s which still not adjusted but occurred the current financial year is helpful to determine the how cash was used during the period.

Cash at the end of period balance must be equal to current balance cash and bank balance. If any difference is found, it means the cash flows statement is not accurate. Find our the error and fix it.

Steps in the preparation of a statement of cash flows

Step 1: Operating Activities:

To determine net cash used by operating activities under the Indirect method net income is adjusted with non cash expenses, gain/loss from investing activities and changes in current assets and current liabilities.

Net Income +/- Adjustments= Net cash provided by operating activities

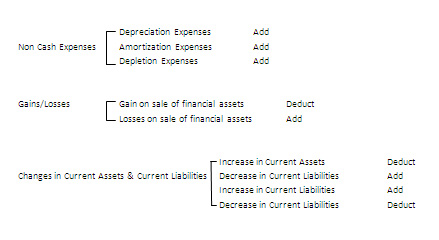

The 3 types of adjustments are discussed in the below

Non cash expenses are usually depreciation expense, amortization expense and depletion. It is added back to net income.

Gain/Loss from Investing and Financing Activities:

The gain on sale of long term financial instrument is deducted from net income. Example- Gain on sale of equipment, Gain on sale of land.

The loss on sale of longterm financial instrument is added back to net income. Example- Loss on sale of building, Loss on sale of plant assets.

Changes in Current Assets and Current Liabilities

Decrease in current assets and increase in current liabilities is added back to net income.

Increase in current assets and decrease in current liabilities is deducted from net income.

Summary of adjustment to net income to net cash provided by operating activities.

Step 2: Investing Activities

Sale of fixed assets is the inflow of cash; the selling price is added to net income.

Purchase of fixed assets is the inflow of cash; so the purchase is deducted from net income. But noted that if fixed asset is purchased through the issuance of bond/stock. The issuance of bond/stock for fixed assets no effect on cash. Then no changes in adjustment is required.

Step 3: Financing Activities

When stocks or bonds are issued for cash, the cash inflow is reported in the financial section. So the issuance of stocks and bonds are added back. But conversion of bonds into common stock or issuance bonds or stock for plant asset do not effect of cash balance. These transaction does not effect on cash flow statement.

When redemption of bonds, cash outflow occurred that means it would be deducted from the net income.

Dividend is declared yet not paid is not effect in cash flow statement but when paid cash would be deducted.

Step 4: Calculation:

Net cash flow from operating activities, investing activities & financing activities are summed up and get net increase (decrease) in cash. Then beginning balance of cash is added with net increase (decrease) in cash. Total summation amount must be equal to ending balance of cash.